FAQs for NDIS SDA Properties

in Australia

Specialist Disability Accommodation Investment Properties

If you are an investor or your loved one is a participant in the National Disability Insurance Scheme (NDIS) in Australia, you may have questions about Specialised Disability Accommodation (SDA).

SDA provides housing for individuals with high support needs, offering specialized living arrangements and necessary on-site support. In this introduction to FAQs, we will address common queries regarding NDIS SDA properties.

From understanding the funding process to exploring options for purchasing SDA properties through a Self-Managed Super Fund (SMSF), we aim to provide clarity on how the NDIS supports individuals with disabilities in finding suitable housing solutions.

Let’s dive into the frequently asked questions about NDIS SDA properties in Australia. Click each questions to find out the answers.

No Result

Introduction:

Australia’s National Disability Insurance Scheme (NDIS) offers assistance and services to people with severe and persistent disabilities. Specialist Disability Accommodation (SDA), or specially constructed homes that meet the unique needs of people with impairments, is a crucial component of the NDIS. SDA properties have a lot to offer, but it’s also important to understand and manage the dangers. The primary risk related to NDIS properties will be identified and discussed below.

Tenant Vacancy and Financial Viability Pose the Greatest Risk.

Tenant vacancy and the investment’s financial viability are the two biggest risks for NDIS properties. For an investor or property owner to see a return on their investment, SDA properties need a steady source of rental income. The following elements raise this risk:

Tenant Demand and Market Conditions: Based on a variety of variables, including changes in NDIS policy, population demographic trends, and regional variances, the demand for SDA accommodations may fluctuate. Long-term vacancies and financial losses may occur from a failure to find and keep suitable tenants.

Property Suitability: To fulfil the requirements of those with disabilities, SDA homes must adhere to strict design and accessibility standards. The pool of potential renters may be less if these conditions aren’t met, which could have an impact on the property’s financial viability.

Long-Term Lease Agreements: Long-term lease arrangements with providers of specialised disability accommodations are customary for SDA properties. These contracts offer stability, but they can also reduce your net income, be negotiated, terminated, or not renewed, which could affect the cash flow of the property.

Maintenance & Upkeep: SDA properties need constant upkeep and repairs to accommodate shifting tenant needs. Tenants’ perceptions of the property’s suitability and appeal may be impacted if accessible elements are not kept up to date and rules are not followed.

Danger Mitigation: It’s vital to consider the following tactics to reduce the danger posed by NDIS properties:

Thorough Market Analysis: Conducting in-depth market research and analysis to pinpoint regions where there is a need for SDA housing and a steady tenant base.

Collaboration with Reputable Specialist Disability Accommodation Providers: Working with companies who have a solid track record of providing tenant management and support services.

Property Maintenance and Compliance: Keeping the building’s accessibility features in good working order, attending to tenant needs, and remaining current with NDIS rules and regulations.

Spreading the investment across several homes or areas of the country can help to minimise the risk of tenant vacancies and shifting local economic conditions.

While NDIS SDA buildings have numerous potentials, the likelihood of tenant vacancy and their financial viability are major causes for concern. Property owners and investors can increase their chances of success in this niche market by being aware of the elements causing this risk and putting the right strategies in place to reduce it. To minimise the possible impact of this risk and guarantee the long-term viability of NDIS SDA investments, it is essential to maintain vigilance, adjust to changing conditions, and seek professional assistance.

Positive Income Properties mitigate risk by attending to these and other aspects from the initial land and build selection to the handover with participants and property management in place to deliver a great investment property that can be the start of a portfolio of numerous high-yield investments.

The possibility for capital growth is one of the most important variables that investors consider when thinking about real estate investments. It is the second part of the overall benefits an owner receives from an investment property being (1) rental income, capital growth or increase in value, and depreciation or tax savings.

The term “capital growth” describes the rise in a property’s worth over time. But the question of whether capital growth is the same for NDIS (National Disability Insurance Scheme) properties versus conventional properties emerges.

Properties under the NDIS, Specialist Disability Accommodation (SDA), have distinctive features and target a particular market. These specially constructed accommodations have been created to specifically cater to the needs of people with impairments. They have a higher cost due to the inclusions and designs needed to comply with the registration and certification requirements. As a result, they function differently than traditional characteristics and have different dynamics.

It is vital to consider several elements that may affect this aspect, even though there is no conclusive answer as to whether the capital growth of NDIS properties is the same as that of traditional buildings.

Factors affecting demand and the market value for NDIS properties.

These factors include regional variances, population demographic changes, and adjustments to NDIS legislation. The capital growth potential of NDIS properties in comparison to typical buildings may be impacted by these dynamics.

Long-Term Lease Arrangements: Specialist Disability Accommodation providers often have long-term lease arrangements with NDIS buildings. These agreements might limit the possibility of market-driven capital expansion, but they might also offer stability.

Specificity and Accessibility: NDIS properties were designed with accessibility requirements for people with disabilities in mind. While this can draw in a particular tenant base, it might also limit its appeal to a wider market, which could influence capital growth.

It is important to keep in mind that several variables, such as location, market conditions, infrastructure development, and economic trends, can affect the capital growth of any property. These elements apply to both traditional and NDIS homes.

In conclusion, due to market dynamics and elements peculiar to the NDIS system, the capital growth potential of NDIS properties compared to typical properties may differ. Investors should carefully analyse the demand, leasing agreements, and accessibility elements while evaluating the capital growth potential of NDIS properties, albeit further investigation and analysis are required to provide a conclusive response. Before selecting a property talk to Positive Income Properties as we have SDAS Australia wide and can direct you to the investment property that best fits your Goals, Aspirations and Budget matching the returns, growth, and tax savings to the selection formula.

Property owners can receive several benefits by investing in NDIS (National Disability Insurance Scheme) rentals, particularly Specialist Disability Accommodation (SDA) over and above traditional rental properties. Here are some major justifications for why NDIS rentals are viewed favourably as investments:

Government Assistance: The NDIS is a government-funded programme that offers financial assistance to qualified people with disabilities. As a result, the NDIS normally pays the rent for NDIS rentals, providing security and stability for investors.

How can the government pay so much rental for SDA bedrooms?

The answer to that question as well as the benefits of investing in a NDIS SDA is demonstrated by the savings the government makes by outsourcing the supply of SDA rooms to private investors show why it is a stable long term property investment.

Government Cost Savings

At Positive Income Properties, we are asked how can the government pay such high rentals?

An SDA participant in a hospital bed costs the government $1000 to $2000 PER DAY depending on their disability.

Hospital Costs

If the government was required to house and care for over 35,000 SDA participants, it would eventually cost over $15 BILLION per year.

Cost of Annual SDA Rentals

The annual budget for SDA Rentals is $800 Million

The average daily government and participant rental for an NDIS SDA room is currently approximately $120 per day.

Main figures

All SDAs in hospital care $15 Billion

All SDA rental cost $800 Million

Current cost for SDA room rental $255 Million

As you can see by outsourcing the supply of accommodation the government has made a great financial decision as well as outsourcing the supply and maintenance of the NDIS SDAs to organisations that have the participants’ interest as their main tenant.

Rental Yield: As Above when compared to conventional residential homes, NDIS rentals typically produce higher rental yields. This is primarily because SDA homes are specialised and meet the specific needs of people with disabilities.

Demand: Because there are less acceptable lodgings than required for people with impairments, there is a high demand for new NDIS rentals. This lowers the likelihood of vacancies by establishing a solid and dependable tenant base.

Long-Term Lease Agreements: Long-term lease agreements with Specialist Disability Accommodation providers are customary for NDIS rentals. These contracts offer investors a reliable source of rental income, frequently with the possibility of longer lease terms and annual rental indexation.

Potential for Capital Growth: While the capital growth of NDIS rentals may be different from that of regular properties, over time, favourable capital growth may be possible due to the rising need for adequate lodging and the dearth of alternatives.

In addition, NDIS SDA properties may also be sold on a commercial basis utilising market cap rate, which depending on the income at the time of sale, could lead to a strong capital appreciation.

Positive Social Impact: By giving people with disabilities the much-needed housing options they require, investments in NDIS rentals enable investors to have a positive social impact. Investors may benefit personally from this and it is consistent with socially responsible investing.

Government Incentives: The government occasionally provides grants or incentives to promote investment in NDIS rentals. These rewards may offer extra financial advantages and raise the overall return on investment.

Potential for Portfolio Diversification: Purchasing NDIS rentals might assist real estate investors who already own a portfolio of conventional homes or businesses diversify their holdings, reducing risk and balancing their entire investment strategy.

Future Growth Prospects: The NDIS framework is still being improved upon, and new disability support services are being added all the time. This highlights future expansion opportunities for NDIS rentals.

The high demand, long-term lease agreements, government support, appealing rental yields, potential for capital growth, positive social impact, government incentives, specialised property management, diversification opportunities, and future growth prospects of NDIS rentals make them a good investment. Before making judgements on investing in NDIS rentals, it is crucial to do extensive research, get professional guidance, and evaluate specific circumstances.

Accordion Sample Descr

Participants in the NDIS: The National Disability Insurance Scheme (NDIS) aids those with severe and persistent disabilities. There are more than 500,000 NDIS participants in Australia as of June 2023.

Participants that are SDA Eligible: Specialist Disability Accommodations (SDA) are not necessary for all NDIS members. SDA is especially created for those who require a lot of support or who have severe functional impairments. There is an estimated 35,000 NDIS users that are eligible which was determined by the NDIS Quarterly Report (December 2022).

Participants with SDAs: The NDIS had over 18,400 SDA participants as of September 2022. The number of people who have been matched with SDA accommodations is shown by this.

Demand for SDA: Several variables, including the number of eligible participants, the availability of suitable properties, and geographical variances, affect the demand for SDA accommodations. Although there isn’t a specific number for the proportion of prospective tenants that want SDA, we can make an educated guess based on the facts at hand.

Approximately 52.6% of eligible participants have been matched with SDA accommodations, according to the ratio of SDA participants (18,400) to all other eligible participants (35,000). This equates to approximately 47.4% of participants still requiring accommodation 16,600 not factoring any new participants that will enter the market.

iption

Unmet Demand: Potential renters who are actively looking for SDA are represented by the remaining qualified participants who have not yet been matched with SDA lodgings. As a result, 16,600 people or almost 48% of the population might be regarded as renters who are actively looking for SDA housing.

Market Variation: Demand for SDA might differ significantly between different geographic areas, with some seeing stronger demand than others. Regional variations are influenced by elements including population density, prevalence of people with disabilities, and accessibility to SDA assets. This is all part of Positive Income Properties research on where to source SDAs for our investors.

It is crucial to remember that the numbers given are rough estimates and is subject to change. Continual adjustments to participant eligibility determinations, policy modifications, and the availability of eligible properties affect the demand for SDA housing.

In conclusion, even though only about 52.6% of those who qualify have been paired with SDA housing, an estimated 47.4% of prospective participants are actively looking for SDA housing. These statistics demonstrate both the current demand for SDA buildings and the prospective market for real estate investors drawn to this specialised industry.

The cost of NDIS (National Disability Insurance Scheme) residences, in particular Specialist Disability Accommodation (SDA), is frequently higher than that of typical homes. This is a result of several variables that raise expenses. The construction and management of SDA homes come with additional inherent hazards. The following main aspects outline the hazards and higher costs associated with NDIS properties:

Factors Affecting NDIS Property Costs:

SDA properties must adhere to accessibility requirements and design standards to satisfy the needs of people with disabilities. Wider entrances, ramps and specialised fixtures are a few examples of adjustments that may raise the price of building and renovating.

Specialised Features and Equipment: To meet the special needs of people with disabilities, SDA properties frequently need additional features and equipment. This may involve costly extras like specialised bathrooms, hoists, assistive equipment, and custom fixtures.

Compliance with NDIS Standards: SDA premises are subject to severe NDIS requirements. Costly upkeep, new construction materials, and safety features may be required to meet compliance standards.

Support Services & Staffing: SDA properties may need staff members and support services on-site to help tenants with everyday tasks and specific care requirements. The overall expenses of housing the carers need to be included in the costs of building a suitable space for the staff on site.

In conclusion, the greater price of NDIS properties compared to ordinary homes is a result of the necessity for support services, specialised features, and compliance with NDIS standards. Regulatory compliance, tenant vacancy, leasing agreement stability, maintenance responsibilities, operational costs, and market conditions are risks connected with developing and managing SDA buildings. To negotiate the difficulties and fully realise the potential of NDIS SDA property investments, investors should carefully consider these considerations and seek professional guidance.

NDIS requirements, building codes, and disability standards must all be followed while creating and running SDA properties. Penalties, delays, and extra costs may occur if certain standards are not met. If the building is not fit for purpose because of build quality and or poor workmanship that can have a devastating effect on renting them to SDA participants.

Positive Income Properties have draughting and plan providers who work with SDA certifiers. Also, they use feedback from the participant providers who are working directly with the people these properties are built to house. We currently have a plan for every type of disability as well as many different configurations for the number of participants living in the home. Our most requested design is our Robust Duplex that houses a single participant and carer side by side but allows for them to have their personal space.

Continuous Maintenance and Modifications: SDA properties need constant upkeep and alterations to meet changing tenant needs and NDIS regulations. Tenant happiness, compliance, and property value can all be negatively impacted by inadequate property maintenance and modification.

Operational expenditures and personnel Issues: When compared to typical rental homes, SDA properties may have greater operational expenditures for support services, personnel, and property management.

A lot of this question is covered in points 1 and 7 but the main focus Positive Income Properties has is our builds are spacious, well built and designed to feel like a home for the participants who live in these NDIS SDAs.

Please see the points below on how we mitigate the risk of low or no rental income due to a lack of participants.

Tenant Vacancy and Financial Viability Pose the Greatest Risk.

Tenant vacancy and the investment’s financial viability are the two biggest risks for NDIS properties. For an investor or property owner to see a return on their investment, SDA properties need a steady source of rental income. The following elements raise this risk:

Tenant Demand and Market Conditions: Based on a variety of variables, including changes in NDIS policy, population demographic trends, and regional variances, the demand for SDA accommodations may fluctuate. Long-term vacancies and financial losses may occur from a failure to find and keep suitable tenants.

Property Suitability: To fulfil the requirements of those with disabilities, SDA homes must adhere to strict design and accessibility standards. The pool of potential renters may be less if these conditions aren’t met, which could have an impact on the property’s financial viability.

Long-Term Lease Agreements: Long-term lease arrangements with providers of specialised disability accommodations are customary for SDA properties. These contracts offer stability, but they can also be reducing your net income, be negotiated, terminated, or not renewed, which could affect the cash flow of the property.

At Positive Income Properties, we do the research, do due diligence, and deliver fit-for-purpose SDAs that the participants and SDA recruiters see as suitable and desirable.

As an SDA (Specialist Disability Accommodation) supplier, I can say that a variety of stakeholders, including disability service providers, support coordinators, and the NDIS itself, are typically responsible for recruiting participants to live in an SDA home.

Participants who wish to reside in an SDA house must normally go through several phases in the recruitment process.

First, the NDIS determines the participant’s eligibility for SDA funding based on their unique support needs and needs related to their disability.

When a participant is declared qualified, their support coordinator or a provider of disability services may help them find acceptable SDA housing choices.

Contacting SDA providers, who oversee and care for the SDA properties, during the hiring process may be necessary to find out about open positions. To match suitable participants with suitable SDA homes, SDA providers frequently collaborate closely with support coordinators or disability service providers. Positive Income Properties work with a team of SDA participant providers across Australia.

The following phase entails participating in a group assessment and planning process.

This entails having in-depth conversations with the participant, their network of supporters, and the pertinent professionals to comprehend their unique needs, goals, and preferences. With the use of this information, the best PIP SDA home may be found for the participant’s needs.

The participant is given comprehensive information about the SDA house, including its location, style, characteristics that make it accessible, and any support services that may be offered, once a prospective match has been made. A visit to the property, inquiries, and decision-making are encouraged for the person and their support system.

The essential documents and agreements, including the lease agreement and any applicable support agreements, are finished if the participant decides to move into the SDA home. The participant’s needs are then met at the SDA home with the help of ongoing care and coordination, which helps ensure a smooth transition.

In conclusion, disability service providers, support coordinators, and SDA providers work together to attract participants to live in SDA homes. It comprises determining eligibility, finding suitable housing options, thorough planning, and assisting the participant with a smooth move.

As a full-service turnkey business Positive Income Properties perform all the tasks below to deliver a tenanted property with professional management.

First off, the NDIS website acts as a thorough resource, offering details on SDA funding, eligibility requirements, and pertinent standards. It provides an overview of the several SDA design categories, including Improved Liveability and Fully Accessible, to assist customers in understanding the distinctive characteristics and specifications of each category.

PIP interact with support coordinators, who are informed about SDA and can offer assistance at any time. Support coordinators can help buyers locate suitable solutions based on their unique needs and preferences because they have access to the most recent information on SDA vacancies.

SDA providers and organisations that specialise in housing for people with disabilities can also be excellent sources of information. They are knowledgeable about SDA procedures, keep current lists of available SDA properties, and can help with the application and selection procedures.

Buyers should ask about areas and regions where there is a significant demand for and a dearth of accessible dwelling options for people with disabilities when evaluating places that require SDA practises. To determine regions where the need for SDA exceeds the current supply, PIP look into local communities, engaging with disability advocacy organisations, and examining demographic data.

Given the scarcity of accessible housing choices for people with impairments, SDA is in high demand. Numerous people live in inappropriate or unsuitable housing, which has a negative effect on their quality of life. SDA is required, and the NDIS has set aside a sizable amount of cash to fill this shortfall. The demand is also spurred by disabled people’s aspirations for increased independence and better housing.

In general, buyers should look at the information they are being supplied and the property details that they have been given from all informational areas including the NDIS website, support coordinators, and SDA providers. Assessing demand and supply is necessary to determine the locations that call for SDA practises, with the demand for SDA being fuelled by the pressing need for accessible housing for individuals with disabilities.

When it comes to taking care of an NDIS SDA property and managing the participants on behalf of the owner, the best course of action is typically to enlist the services of a disability service provider that is both respectable and knowledgeable in the field. Disability service providers are experts in the field of aiding and care to people living with disabilities. They also possess the knowledge and experience necessary to efficiently administer SDA facilities.

Positive Income Properties arrange participant recruitment and property management for all our NDIS SDAs we sell to our clients.

A provider of disability services can undertake a variety of obligations that are associated with property management. These responsibilities include tenant selection, continuous assistance coordination, and ensuring that the requirements of the participants are satisfied. They have a comprehensive knowledge of the NDIS framework as well as the SDA rules, which guarantees that they will comply with all applicable regulations.

In addition, disability service providers often already have established networks and relationships within the community of people with disabilities. These networks and connections can help simplify participant recruitment and ensure a smooth transition for people moving into SDA property.

When choosing a provider of services for people with disabilities, it is essential to take into consideration the provider’s level of experience, track record, and reputation within the sector. Employing a supplier who has a proven track record of providing high-quality support and successfully maintaining SDA properties can give the owner piece of mind and ensure the participants’ well-being at the same time.

In the end, forming an alliance with a credible disability service provider provides access to the skills, assistance, and specialised knowledge that are necessary for the efficient management of an NDIS SDA property and the provision of the best possible care and support for the participants involved is part of the Positive Income Properties role.

At Positive Income Properties, we can offer advice regarding which of the four disability sections is best able to accommodate different types of disabilities. The personal needs of each person should always be taken into consideration, even though some sections may be better suited for people with various disabilities. The following sections on disabilities have the capacity to serve people with a variety of disabilities:

Fully Accessible: This category caters to a wide range of disabilities and is intended to offer high levels of accessibility. Features like step-free access, bigger doorways, movable fixtures, and accessible restrooms are all included.

Robust: Housing that is strong and resilient enough for people with complicated needs is the emphasis of the Robust design category. It can accommodate a range of disabilities, including those affecting movement and specific sensory or cognitive limitations.

High Physical Support: This group is for people who require a lot of physical support. Although it is primarily designed for those with severe physical disabilities, it can also serve some persons with other sorts of disabilities who need specialised support and accessibility features.

Improved Liveability: Although primarily designed for people with intellectual, sensory, or cognitive disabilities, the Improved Liveability category can be adapted to and is appropriate for people with various types of disabilities, especially if adjustments are made to fit needs.

To analyse specific needs and choose the best SDA design category for a person with several types of impairments, it's crucial to speak with a support coordinator or disability service provider.

At Positive Income Properties, we feel it is vital to point out that the disability sector that is most suitable for an individual relies on their own requirements, inclinations, and objectives. Nevertheless, taking into consideration the extensive needs of people with impairments, the following areas for people with disabilities are frequently regarded as beneficial:

Fully Accessible: This category focuses on high levels of accessibility and can be suitable for those with a wide variety of disabilities, including mobility impairments, sensory disabilities, and cognitive disabilities. Those who fall into this group have high expectations for the accessibility of the product or service they get. Access without the need for steps, wider entrances, adjustable fixtures, and restrooms that are easily navigable are some of the amenities that may be included.

Improved Liveability is a category that focuses on ways to make dwellings more liveable for people who may have intellectual, sensory, or cognitive impairments. It is possible to adjust it such that it may accommodate a wide variety of disabilities, particularly if modifications are made to satisfy unique requirements.

High Physical Support: High levels of physical help are available in this area, which was created expressly for residents who require a high degree of assistance in this area. Support for those who have significant physical disabilities is provided through the installation of amenities such as ceiling hoists, specialised bathing facilities and accessible technologies.

The Robust category places an emphasis on long-lasting and resilient housing that is suited to the requirements of individuals who have a variety of complex needs. It is able to accommodate a wide variety of disabilities, such as those with mobility, sensory, or cognitive limitations.

Assessing the individual's needs, consulting with support coordinators or disability service providers, and taking into consideration issues such as accessibility, support requirements, and the individual's aspirations for independent living and quality of life are all essential steps in the process of selecting the most appropriate disability sector.

The best investment is the one the delivers for all parties and has a high rate of occupation and harmony in the SDA. We work on these factors for all our SDA selections.

In Australia, the cost of a turnkey SDA (Specialist Disability Accommodation) property can vary greatly based on several elements, including as its location, size, design elements, and the needs of the participants. Here are some broad ideas to keep in mind, though:

SDA Property Pricing Categories: There are four price tiers for SDA properties, from Improved Liveability to High Physical Support. The cost varies according to the degree of specialised features offered and how extensive the support requirements are.

Location: In Australia, the land cost of the SDA cost can range significantly between various states, cities, and even individual neighbourhoods.

Property Size and amenities: Prices may be more for larger SDA properties or those with extra amenities like completely accessible bathrooms, specialised equipment, or cutting-edge technological systems.

Developer and Builder Factors: Depending on their costs, profit margins, and quality requirements, different developers and builders may have different pricing structures.

It's crucial to remember that market factors, building costs, and the availability of funding through the NDIS (National Disability Insurance Scheme) all have an impact on how much turnkey SDA buildings cost. It is advised to speak with SDA providers, developers such as Positive Income Properties who specialise in SDA homes in order to acquire the most precise and recent pricing information. We may give customised pricing information based on the current situation of the market and particular needs.

We currently have properties Australia-wide with returns from 13% to 22% and from $735,000 to $980,000. We can help you with your Goals, Aspirations and Budget.

Australian property buyers often put 20% down. For a $850,000 property, a 20% deposit is $170,000.

It's important to understand that deposit requirements differ by lender and buyer's financial situation. Some lenders require greater deposits, while others provide 10% deposits.

At Positive Income Properties, we can work with your broker or bank but be aware the big four banks will not lend directly for NDIS SDAs. We do not know the reason why this is the case but that is their guidelines.

We have a network of brokers who can arrange finance at competitive rates and sometimes at a lower deposit percentage than the standard 20% required In cash or equity.

When you have determined you want to proceed with buying a Positive Income Properties SDA, we can connect you with this network that will help position you in the best position to complete this purchase and perhaps repeat it in a short space of time.

We normally arrange a commercial valuation supported by a rental appraisal supplied by our SDA tenancy partners, which help us deliver a valuation based on the income as well as the cost of the land and building.

We realize that by obtaining A grade finance our clients have a very strong chance of buying further SDAs in a short space of time.

SDA properties' participant recruitment costs should be considered by clients when looking at the whole picture. We have seen demands for an extra $40,000 to $65,000 over and above the cost of buying an NDIS SDA.

The actual costs depend on recruitment scope, target demographics, and strategy.

Key participant recruitment costs: they should not be a money grab.

Our average SDA recruitment costs are around $5,000 per person and the property management can range from one to three weeks’ worth of rental.

Some legitimate costs that are bundled up in a SDA recruiter account can be:

Advertising and marketing: Creating pamphlets, flyers, and online ads.

Reaching participants using social media, websites, and online advertising.

Promoting recruiting with disability advocacy, support, and community organisations.

Human Resources: Interviewing, screening, and assessing participants requires staff time.

Hiring extra help if needed.

Reaching Out: Informing potential participants about the SDA property and its benefits through information sessions, workshops, or community activities.

Responding to participant questions by phone or email.

Payments due: SDA providers or recruitment managers usually cover participant recruitment fees.

Agreements and contracts determine payment schedule. After participant selection or tenancy agreement signing, payments may be made.

Participant recruitment costs vary depending on geography, context, and strategy. To estimate participant recruitment costs for an SDA property, consult SDA providers, disability service organisations, or recruitment professionals.

Positive Income Properties has Australia covered with our SDA property management partners and the properties we sell our clients are part of our full service business that covers from the initial conversations about your goals aspirations and budget, to the handover of your new build SDA with participants and property management in place.

Positive Income Properties works with insurance brokers who understand NDIS SDA property requirements and can provide PIP investment protection plans.

Property owners can protect their investments with landlord and property insurance. They have comparable coverage but different audiences. Brief descriptions follow:

Landlord insurance: Landlord insurance covers landlords who rent out residential homes. It covers property rental risks and losses.

Coverage:

- Property Damage: Repairs or rebuilds insured property damaged by fire, storms, vandalism, or other risks.

- Liability Insurance: Covers landlord negligence claims if a tenant or visitor is hurt on the rental property.

- Loss of Rental Income: Covers financial losses if covered damages make the property uninhabitable and the landlord cannot collect rent during repairs.

- Legal Expenses: Covers landlord legal fees for eviction proceedings.

- Contents Insurance (Optional): Protects the landlord's furniture and appliances from damage or theft.

Investment Property Insurance: Investment properties need specific insurance to protect the owner's financial investment and mitigate hazards connected with renting. Investment property insurance includes:

- Property Insurance: Protects the investment property's structure from fire, storms, vandalism, and theft, preserving its value and funding repairs or rebuilding.

- Liability Insurance: Covers legal fees and settlements if a tenant or visitor is injured on the property and holds the landlord accountable.

- Flood Insurance (if applicable): Investment properties in flood-prone areas may need flood insurance, which is not usually included in ordinary property insurance.

- Umbrella Insurance: Suitable for landlords with several investment properties to safeguard against large lawsuits.

- Contents Insurance (Optional): Protects the landlord's appliances and items in the rented property.

The right insurance for an investment property protects the landlord's financial interests, prevents liability, and ensures a constant rental income. Review and customise insurance plans for each investment property and area. Call us as an insurance professional can assist property owners choose the right coverage.

Please note you need to budget that you will have costs while your property is being built.

You need to consider annual council rates costs, which are levied by the local council and used to fund things like garbage collection, maintenance of public buildings, and other such governmental expenditures.

Utilities: water costs should all be factored in.

Your next cost will be the stamp duty on the land as you now own the land.

This cost varies by state and by the amount that the land has cost. The good news here is the stamp duty paid is only on the land so it will be substantially less than stamp duty on a house and land purchase. The savings can be tens of thousands of dollars in most cases.

The largest cost will be the bank interest on your loan, unless you are paying cash.

The bulk of your holding cost if you have a loan will be mortgage payments. This cost is calculated by multiplying the loan principal by the interest rate multiplied by the loan period.

This cost will depend on the specifics of the mortgage agreement. In this case, we can use 80% but over a split as you do NOT pay all the build costs upfront.

There are the following stages you need to plan for;

- 5% unconditional

- Slab

- Frame

- Enclosed

- Fit out

- Handover

Most of the SDA participant suppliers may require payment for the recruitment process and as that is an individual matter it is case by case depending on the provider.

Your broker will be aware of these costs and should include them into the loan feasibility, but make sure you ask the questions on holding costs until the property is cashflow positive.

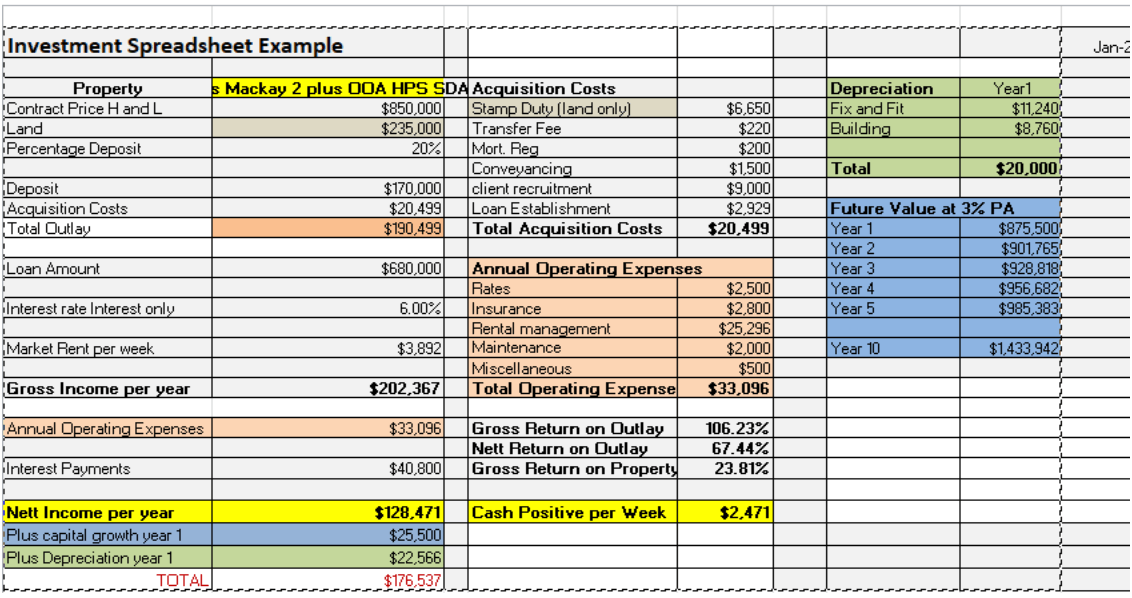

We will demonstrate the annual operating expenses for a $850,000 SDA (Specialist Disability Accommodation) home but It's crucial to remember that operating costs might change depending on the size, location, features, and specifics of a property as well as other considerations. Here are some important factors to keep in mind when calculating running costs:

Mortgage Repayments: Based on the loan amount, interest rate, and loan period, determine the annual mortgage repayments. The exact conditions of the mortgage will determine this.

Council Rates: Take into consideration the yearly council rates, which are imposed by the local council and pay for services like garbage collection, upkeep of public facilities, and other local government fees.

Utilities: Take into account the price of water, and even gas and electricity.

Other Expenses: Consider other costs like strata fees (if applicable), and any unique demands for accessibility features or participant support services.

Add up the mortgage payments, insurance, council rates, utilities, and other pertinent expenses to get an idea of the property's annual operating costs for a $850,000 SDA home.

Please see below for an example of an NDIS SDA we have sold that is a cash sale, so no bank interest is in the calculation.

These figures are remarkable and are supported by the NDIS calculator.

Once you have purchased an NDIS SDA and it is delivering a positive cash flow the second and future purchase become easier and easier. Why because they are improving your ability to borrow as they have positive income, tax benefits (Depreciation) and capital growth.

According to a financial expert, the amount of money needed to purchase a second NDIS SDA (Specialist Disability Accommodation) property would vary depending on a number of variables, such as the property's purchase price, your financial status, and the lending alternatives accessible to you.

Here are some things to think about when determining how much money you'll need to buy a second NDIS SDA property:

Deposit: Typically, only 10% of the purchase price is requested as a down payment. The purchase price and the conditions of the lending institution will determine the precise deposit amount. Although this varies, certain lenders might provide solutions with lower deposits, like 5%.

Loan Amount: A mortgage loan will cover the balance of the money required to buy the property. The purchase price less the deposit will determine the loan amount.

Associated Costs: There are several associated costs to take into account in addition to the purchase price and deposit, such as:

Fees for loan applications and startup expenses:

- Legal and stamp duty costs.

- Taxes levied by the state government, such stamp duty.

- Mortgage insurance provided by the lender, if necessary. (depends on % borrowings)

Additional Resources Additionally, it's critical to have money set aside for property-related continuing expenses and emergencies, such as:

- Holding expenses, such as mortgage payments, fees for property management, insurance, rates, and upkeep.

- Possible vacancy times.

At Positive Income Properties, we have clients who are now on their third property with a completed build income of over $500,000 per year gross.

The first step to financial freedom is your first NDIS SDA from Positive Income Properties.

Once an SDA is constructed and tenanted it will have a commercial “Going Concern” value that can add a significant increase to a property that was built with a mid to high teen percentage rental return.

A going concern can add tens if not hundreds of thousands of dollars to the value of a Going Concern SDA.

Based on a 3 to 4% change in return, an 18% return that goes back to 14% on a $800,000 property will increase the value by 4% of $800,000 or $320,000 making it worth $1,120,000, which will allow you to use that uplift to purchase your next SDA.

Another example is.

$1.000,000 SDA

$200,000 income

20% income

Built and rented to long term participants.

New values

$200,000 income

Sell on 12% return as a Going Concern

Value $1,666,000 or an increase of over $660,000 in less than two years.

We suggest you talk to your financial planner, but these numbers are real and can be generated with the correct property purchases.

Call us to discuss your first purchase and how we can have you in a positive cash position with your first property.

The National Disability Insurance Scheme (NDIS) is here to stay as the NDIS was created to offer long-term and sustainable funding for people with disabilities, and it represents a substantial change in Australia's approach to disability support. Here are a few explanations for why it is anticipated that the NDIS would endure indefinitely:

Legal basis: The National Disability Insurance Scheme Act 2013 established the NDIS and provides the basis for its functioning. Such legislation would take strong political resolve and protracted consultations to change or repeal.

Broad Support: The NDIS is supported widely by organisations that advocate for people with disabilities, service providers, and the public. The program's ability to improve the standard of living and support for people with disabilities has received widespread recognition.

Long-Term Funding Commitment: The Medicare levy, a dedicated tax, and other government funds are used to pay for the NDIS. The NDIS's stability and sustainability are guaranteed by the commitment to sustainable and ongoing funding.

Positive Results: Since its implementation, the NDIS has produced favourable results, enabling individuals with disabilities to lead more independent and satisfying lives by providing necessary services, supports, and opportunities. These favourable results confirm the necessity and worth of the plan.

Supporting people with disabilities is not only morally required, but it is also a matter of economic and societal necessity. As it supports larger social goals and objectives, the NDIS is crucial in advancing inclusion, accessibility, and equality.

The NDIS is deeply ingrained in Australia's system of disability care, even if modifications and improvements may be made over time to improve the scheme's implementation. Long into the future, it is anticipated to continue offering crucial support to those with disabilities and their families.

We have outlined all the points that our clients have been asking us since the start of the NDIS SDA investment property when it began in Australia.

Currently we have over 50 owners we are working with who have committed to owning a high yielding residential investment, that has government backing. The recent huge increases in the rental income by the NDIS has taken our enquiry rate to levels we have not seen before and as per our last FAQ subject, supply will eventually meet demand and it will only be replacement property sales.

When is the best time to start? Now as we have the largest selection of locations and designs, we have ever had all around Australia and SDA participant partners who have people who need accommodation as soon as possible.

Start the process by booking a meeting on our website https://positiveincomeproperties.com.au/ or email sales@positiveincome.com.au or call 07 5408 4151.

From there you can secure a property with a commitment form and $990 and we get into action and do all the work to deliver a fully turnkey SDA with property management and participants in place.

Make a difference for you, your family and the disability participants and contact us today to start the journey to financial independence and a positive income.